Single-Member LLC: The ultimate guide

Starting a business involves some key decisions, and one of the most important is choosing the right structure. For many entrepreneurs, the choice comes down to a sole proprietorship or a limited liability company (LLC). While a sole proprietorship is simple, it doesn’t offer the same level of personal protection as an LLC. That’s where the single-member LLC (SMLLC) stands out: it combines the simplicity of a sole proprietorship with the added benefit of personal liability protection.

This article will guide you through what a single-member LLC is, who can form one, and why it’s an attractive option for business owners. We’ll break down the steps to set up an SMLLC, outline the benefits, and explain how it can protect your assets and give you greater flexibility in managing taxes. Whether you’re starting a new venture or rethinking your current setup, understanding the advantages of a single-member LLC can help you make an informed choice that suits your goals.

Simplified Explanation of Single-Member LLCs

When starting a business, one of the first decisions you’ll make is the structure: either a sole proprietorship or a limited liability company (LLC). You might already know some benefits of an LLC, but did you know you can start an LLC as a single person? This is called a single-member LLC.

What Is a Single-Member LLC?

A single-member LLC (SMLLC) is a type of business that limits the owner’s personal liability. there’s only one owner who controls the business, unlike multi-member LLCs with multiple owners.

Who Can Form a Single-Member LLC?

Nearly anyone, including U.S. citizens, non-U.S. residents, corporations, and other LLCs, can set up a single-member LLC. The process involves choosing a business name, selecting a state to register in, appointing a registered agent, and filing paperwork with the Secretary of State. Requirements may vary, so check local regulations.

Benefits of a Single-Member LLC

- Personal Liability Protection

Unlike a sole proprietorship, a single-member LLC separates personal assets from business debts. If the LLC faces legal or financial issues, your personal assets—like your bank account or home—are protected. However, you need to keep personal and business finances separate, known as maintaining a “corporate veil.” - Flexible Management Structure

In a single-member LLC, you have two management options:- Member-Managed: You handle all decisions.

- Manager-Managed: You can appoint someone else to manage daily operations while you focus on big-picture decisions.

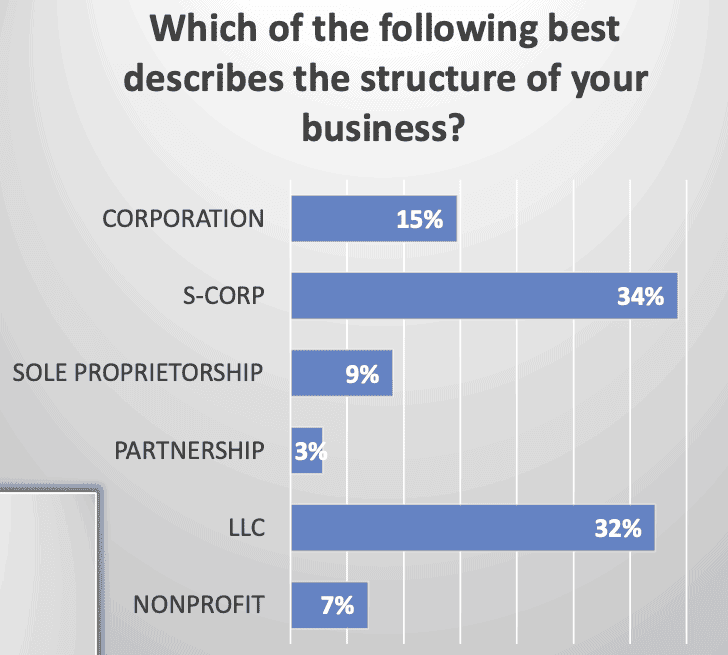

- Tax Options

Single-member LLCs have tax flexibility. By default, they’re taxed as sole proprietorships, meaning you report profits on your personal tax return. However, you can also choose to be taxed as an S-Corporation or C-Corporation. This may allow you to save on taxes by paying yourself through dividends or profit distributions. - Business Compliance

Single-member LLCs must follow state rules, which could include filing an annual report or obtaining a general business license. This helps maintain good standing with the state and protects your limited liability status.

Why Consider a Single-Member LLC?

Compared to a sole proprietorship, an SMLLC offers personal asset protection, tax benefits, credibility, and growth potential. Although it may require a bit more paperwork and cost, the protection and advantages can be worthwhile for many business owners.

Faqs

What is a single-member LLC?

A single-member LLC (SMLLC) is a type of limited liability company with one owner. It offers personal liability protection, which means your personal assets are generally protected from the business’s debts and liabilities.

Who can form a single-member LLC?

Almost anyone can form a SMLLC, including U.S. citizens, non-U.S. residents, other LLCs, and corporations. Be sure to check specific state requirements before you begin.

How is a SMLLC different from a sole proprietorship?

The main difference is liability protection. While a sole proprietorship doesn’t separate personal and business assets, an SMLLC does, protecting the owner’s personal assets from business debts and legal issues.

What are the tax options for a SMLLC?

By default, SMLLCs are taxed as sole proprietorships, meaning the owner reports business income on their personal tax return. However, they can choose to be taxed as an S-Corporation or C-Corporation, which may offer additional tax advantages.

What are the steps to form a SMLLC?

To form an SMLLC, you’ll need to:

* Choose a business name

* Select a state of incorporation

* File formation documents with the Secretary of State

* Appoint a registered agent

* Obtain an Employer Identification Number (EIN)

* Meet state and local compliance requirements, such as annual reportsDo I need an EIN for a SMLLC?

Yes, even if you don’t have employees, having an EIN is required for tax reporting, opening a business bank account, and other administrative purposes.

Can I manage a SMLLC on my own?

Yes, an SMLLC can be either member-managed, where you oversee daily operations, or manager-managed, where you appoint someone else to handle day-to-day tasks.

Do I need an operating agreement for a single-member LLC?

While not always required by state law, an operating agreement is recommended. It outlines the business structure, management roles, and operational guidelines, helping maintain the “corporate veil” that protects personal assets.

What are the compliance requirements for a single-member LLC?

Requirements vary by state but often include filing an annual report, paying state fees, and, in some states, having a general business license. Check your state’s specific requirements to stay in good standing.

Does a single-member LLC pay more taxes than a sole proprietorship?

Generally, no. SMLLCs and sole proprietorships are taxed similarly by default. However, some states have specific LLC fees, like franchise taxes, which may add to costs.

What is “limited liability” in a single-member LLC?

Limited liability means your personal assets (like your home or personal savings) are usually safe if your LLC faces debts, lawsuits, or other financial issues, as long as you keep business and personal finances separate.

Can I convert my sole proprietorship to a single-member LLC?

Yes, many business owners convert their sole proprietorships to SMLLC to gain liability protection and enhance credibility. The process generally involves filing formation documents and paying associated state fees.

What are the main benefits of a SMLLC?

Key benefits include personal liability protection, tax flexibility, greater credibility, and the ability to expand your business while protecting your personal assets.

How much does it cost to form a SMLLC?

Costs vary by state and may include filing fees, annual fees, and, in some cases, taxes like franchise fees. Check with your state’s Secretary of State for specific costs.

What is a “disregarded entity”?

A disregarded entity is a term used by the IRS to describe SMLLCs that are taxed like sole proprietorships. This means income is reported on the owner’s personal tax return rather than a separate business return.

Conclusion:

A single-member LLC offers a unique balance of simplicity, liability protection, and tax flexibility that makes it a popular choice for solo entrepreneurs. Unlike a sole proprietorship, an SMLLC safeguards your personal assets, allowing you to separate personal and business finances while maintaining full control over operations. Additionally, the option to choose your tax status provides a level of financial flexibility that many business owners find beneficial.

While forming and maintaining an SMLLC may require some upfront effort and minor ongoing compliance, the benefits—ranging from personal liability protection to credibility and growth potential—can significantly outweigh the costs. For many small business owners, a SMLLC is a smart, strategic step that enables them to focus on growing their business with peace of mind.